Some Known Details About Insurance Agency In Dallas Tx

Wiki Article

Home Insurance In Dallas Tx for Beginners

Table of ContentsThe Ultimate Guide To Life Insurance In Dallas TxInsurance Agency In Dallas Tx - An OverviewLife Insurance In Dallas Tx - The FactsThe smart Trick of Commercial Insurance In Dallas Tx That Nobody is DiscussingThe 9-Minute Rule for Health Insurance In Dallas TxHome Insurance In Dallas Tx Things To Know Before You Buy

The premium is the quantity you pay (typically monthly) in exchange for wellness insurance coverage. Cost-sharing refers to the part of eligible medical care costs the insurance company pays as well as the portion you pay out-of-pocket.High-deductible strategies cross classifications. Some are PPO strategies while others may be EPO or HMO plans. This kind of medical insurance has a high deductible that you need to meet prior to your medical insurance protection takes effect. These plans can be ideal for individuals that wish to save money with low regular monthly costs as well as do not plan to utilize their clinical insurance coverage thoroughly.

The disadvantage to this sort of protection is that it does not satisfy the minimum necessary insurance coverage needed by the Affordable Care Act, so you may also be subject to the tax obligation penalty. Additionally, short-term strategies can exclude coverage for pre-existing problems. Temporary insurance policy is non-renewable, as well as doesn't include coverage for preventative treatment such as physicals, vaccines, dental, or vision.

Examine This Report on Truck Insurance In Dallas Tx

Consult your own tax, audit, or lawful advisor rather of relying upon this post as tax, bookkeeping, or lawful suggestions.

You can usually "leave out" any kind of household member who does not drive your automobile, however in order to do so, you have to send an "exemption kind" to your insurance firm. Motorists who just have a Student's Authorization are not required to be listed on your plan till they are completely certified.

Truck Insurance In Dallas Tx for Beginners

You need to acquire insurance policy to safeguard on your own, your family, as well as your wide range (Life insurance in Dallas TX). An insurance plan might conserve you hundreds of bucks in case of a crash, ailment, or catastrophe. As you hit particular life landmarks, some plans, including health insurance as well as automobile insurance policy, are virtually required, while others like life insurance as well as special needs insurance policy are highly urged.Crashes, disease and catastrophes occur all the time. At worst, occasions like these can dive you into deep financial spoil if you do not have insurance coverage to drop back on. Some insurance coverage are unavoidable (think: automobile insurance coverage in many US states), while others are merely a clever economic choice (think: life insurance policy).

Plus, as your life changes (claim, you obtain a new job or have an infant) so needs to your protection. Below, we've clarified briefly which insurance policy coverage you need to highly take into consideration purchasing every stage of life. Note that while the plans below are organized by age, of course they aren't good to go in stone.

Truck Insurance In Dallas Tx Fundamentals Explained

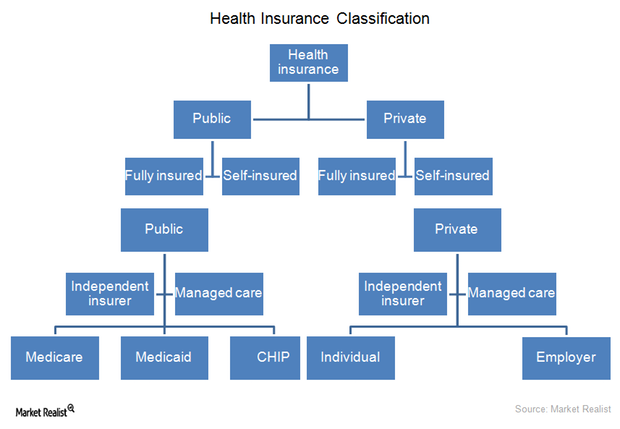

Right here's a brief summary of the policies you need as well as when you require them: Many Americans need insurance policy to pay for medical care. Picking the plan that's right for you might take some research, however it offers as your first line of defense versus medical debt, one of greatest resources of financial obligation amongst customers in the United States.In 49 of the 50 US states, motorists are needed to have car insurance to cover any type of potential building damages and bodily injury that may result from a mishap. Vehicle insurance coverage rates are mainly based upon age, credit history, vehicle make and design, blog here driving document and also location. Some states also consider gender.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

Health Insurance In Dallas Tx for Dummies

An insurer will consider your residence's place, along with the size, age and also build of the residence to determine your insurance coverage premium. Houses in wildfire-, hurricane- or hurricane-prone locations will generally command higher costs. If you market your residence and go back to leasing, or make various other living plans (Life insurance special info in Dallas TX).

For individuals that are aging or handicapped as well as need aid with daily living, whether in a nursing home or through hospice, long-term care insurance can help shoulder the inflated costs. This is the kind of thing individuals do not think of till they grow older and understand this could be a truth for them, but certainly, as you age you get extra costly to insure.

Generally, there are 2 kinds of life insurance intends - either term or long-term strategies or some combination of the two. Life insurers supply different forms of term strategies as well as conventional life plans in addition to "interest delicate" products which have actually ended up being a lot more common given that the 1980's.

The Single Strategy To Use For Truck Insurance In Dallas Tx

Term insurance policy gives security for a given period of time. This duration can be as brief as one year or supply protection for a details variety of years such as 5, 10, twenty years or to a specified age such as 80 or in many cases up to the earliest age in the life insurance policy death tables.The longer the assurance, the higher the initial costs. If you die during the term duration, the firm will certainly pay the face amount of the plan to your recipient.

Report this wiki page